The local market has been slow to fully catch its spring stride this year, though sales activity is trending in the right direction with unit sales up 7% year to date. Although sales activity is picking up, we are seeing listing inventories building significantly across the region with 40% more active listings available for sale compared to the same time last year across our board. Months of inventory is at 7 months which is indicative of a market that is slightly favouring Buyers but some of our micro markets are well into Buyers market territory (more to come below).

The past 2 weeks has brought a marked increase in both showing and sales activity, which provides me with some optimism that spring demand will catch up with the pace of supply and bring our market back to a healthy balance. It is worth noting that the market is performing very differently across different price points and micro regions. Homes under $1,200,000 are generally selling well right now while the demand for luxury properties over $1,500,000 continues to be soft. It is to be expected that the high price points would be the last to recover, this can be partly explained by the discretionary nature of many of the purchase decisions in this segment.

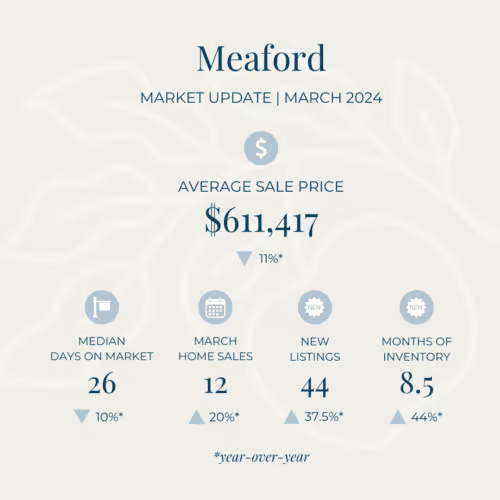

Regionally, Collingwood has significantly outperformed its neighbours to the west with sales up 30% YTD. The Blue Mountains is off to a slow start with unit sales down -8% YTD while Meaford is up 15% YTD respectively. It is worth keeping an eye on listing inventories in each of these areas to help predict the direction of pricing over the coming months. While Collingwood is experiencing a balanced market with 6 months of supply, the Blue Mountains and Meaford have close to 9 months of inventory, which is indicative of a market that is heavily favouring buyers. If we don’t see demand significantly pick up in the Blue Mountains and Meaford, look for there to be continued downward pressure on prices. Remember, it is still relatively early in the spring cycle so a quick recovery in terms of sales is still a very real possibility.

Interest Rate Update:

This week, the Bank of Canada made the decision to maintain interest rates at 5%, for the 6th consecutive time.

Chief Economist Tim Macklem said: “we are seeing what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained. The further decline we’ve seen in core inflation is very recent. We need to be assured this is not just a temporary dip.”

Although the announcement was not the rate cut that many buyers and sellers were hoping for, the Bank of Canada’s recent consistency has provided some stability to the real estate market and as a result sentiment has continued to improve. Many experts are predicting that we will likely start to see some rate relief by summer.

As we move forward, we’ll keep a close eye on any developments and how they may impact the housing market. As always, don’t hesitate to reach out if you have any questions!

Book a Consultation with Us

Thinking about your next home sale or purchase? Get the process started and reach out to our team today.